✕

Column: industry Tag: Australia Hotel Market Published: 2016-06-15 14:19 Source: Author:

According to the Australian Bureau of Statistics (ABS), as at June 2015 Australia’s accommodation supply showed an increase of 8.2% predominantly due to a change in the Survey of Tourist Accommodation (STA) frame, which resulted in the identification and subsequent addition of 279 establishments (18,927 rooms).

Strong trading market fundamentals in major accommodation markets are anticipated to result in ongoing supply growth in the short to medium term. Major projects in Sydney include Crown Hotel at Barangaroo, Sofitel Sydney Darling Harbour and an extension of Four Points by Sheraton. In Melbourne, projects underway include Four Points by Sheraton, QT Hotel & Residences and Ritz Carlton. Projects in Brisbane include the W Hotel and Holiday Inn Express, while projects in Perth include the InterContinental Perth, Doubletree by Hilton, Westin Perth, Crown Burswood and Aloft.

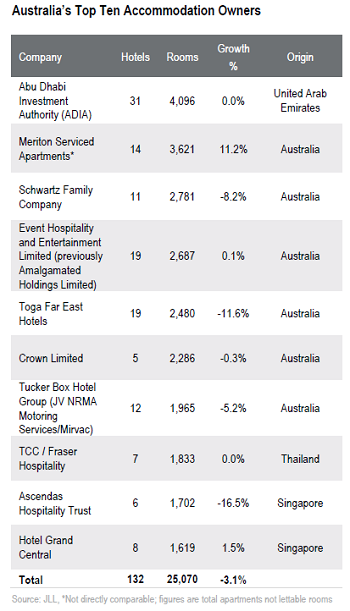

According to the STA frame, there were a total 248,573 accommodation rooms in Australia as at June 2015, of which the Top Ten Owners accounted for 10.1% (25,070 rooms) of total room supply at the end of 2015 and the Top Ten Operators accounting for 40.4% (100,301 rooms).

Rooms owned by the Top Ten Owners have increased at an average rate of 0.9% per annum since 2000. This is marginally below the growth in total accommodation supply. The Top Ten Operators have grown at a higher rate averaging 5.5% per annum.

Top Owners 2015

Australia’s Top Ten Owners recorded a 3.1% decrease in rooms in 2015 with the reduction of 806 rooms. Major movement amongst the Top Ten Owners included Stamford Land Corporation (dropping from 10th position to 12th) with the closure of Stamford North Ryde in January 2015 (256 rooms). This movement has resulted in Hotel Grand Central becoming a new entrant in the Top Ten (from 13th position last year).

The Abu Dhabi Investment Authority (ADIA), the largest sovereign wealth fund in the Middle East, still holds the number one position since its takeover of the TAHL portfolio in 2013.

The group accounts for 16.3% of the Top Ten Owners’ rooms, with 475 more rooms than the next nearest ranked owner.

Since securing second ranking in 2013, Meriton Serviced Apartments (MSA) has maintained this position in 2015. We note, however, that this is based on total apartments and not lettable room count.

Out of the Top Ten Owners, MSA reported the largest increase in room inventory at 11.2% year on year (MSA Chatswood, 337 apartments).

Schwartz Family Company maintained its third placing in 2015 despite the disposal of the Holiday Inn Sydney Airport (250 rooms) in late 2014.

Toga Far East reported a decline of 11.6% following the divestment of the Adina Apartment Hotel Brisbane (162 rooms) and Vibe North Sydney (165 rooms). Despite these transactions, Toga Far East maintained a Top Ten ranking at fifth place.

Offshore groups account for 50.8% of rooms owned by the 30 largest accommodation owners in Australia (by room count), representing a marginal decline y-o-y of 2.5%.

Australian hotel real estate continues to be of significant interest to international investors. Some of last year’s major transactions comprising offshore investment in 2015 included Hilton Sydney, The Westin Sydney and Four Points by Sheraton Perth.

Top Operators 2015

Australia’s Top Ten Operators accounted for 40.4% of Australian total room supply at the end of 2015, with the collective number of properties having reached 1,051 comprising some 100,301 rooms. This represents an increase of 2.9% compared to 2014 with the addition of 2,814 rooms. Despite this growth the Top Ten ranking order did not fluctuate, though strong growth was reported by Mantra Group (25.1%).

Notably, Mantra Group increased their portfolio by a total of 11 properties (+3,603 rooms), the Quest Apartments portfolio grew by four properties (+368 rooms) and InterContinental Hotels Group added one property (+196 rooms).

Australia’s largest accommodation operator, Accor, continues to hold the number one position despite a marginal decline in rooms. Apart from the aforementioned Operators, Oaks Hotels & Resorts and Toga Far East Hotels also reported growth throughout 2015 at 2.6% and 0.6%, respectively.

Domestic groups account for 49% of the rooms operated by the 30 largest Australian accommodation operators (by rooms). This compares to 23% in 2000 and highlights how domestic players have gained market share over the past decade, underpinned by the growth in serviced apartments. Groups that have adopted this structure, as well as franchising, have demonstrated success in growing their Australian portfolios.

Moving forward we expect to see more brand diversification by operators as they seek to further differentiate product offering within the Australian market. As previously observed, the development pipeline is gaining pace with numerous projects currently underway in Australia’s major markets.

Given the strong trading fundamentals across most of the major Australian markets, combined with a resurgence in our resort markets, the introduction of new brands will present an opportunity for owners and operators to experiment with a more diverse product offering, thus broadening overall appeal to different segments.

Major projects currently underway include new and emerging brands for the Australian tourism accommodation market such as DoubleTree by Hilton, Autograph Collection by Marriott, Ritz-Carlton, Aloft by Starwood, QT and Atura by Rydges, as well as TRYP by Wyndham.

We continue to see an increasing number of international parties interested in expanding their portfolios throughout the Australian hotel market, namely from Asia, such as NEXT by SilverNeedle and Capri by Frasers. Global consolidation in the sector, such as Marriot’s proposed acquisition of Starwood, is expected to impact the 2016 Top Operator profile.

As new brands or evolving brands from other regions are introduced to the Australian market, while remaining supportive, we always recommend owners ensure they do not bear all of the financial risk associated with adopting a pioneer brand.

Source:JLL

Previous:The Hilton Cleveland Downtown opens its doors

Next:The Korean chain Caffebene to face some troubles

Hot key words

Hot Products

Popular Vendors