✕

Column: industry Tag: Canadian hotel industry,Canadian hotel,hotel industry Published: 2017-06-23 16:11 Source: Author:

HENDERSONVILLE, Tennessee—With multiple events planned throughout the year to celebrate its 150th anniversary of Confederation, Canada is expected to draw an increased number of inbound visitors who should continue to buoy its hotel industry throughout the rest of the year, according to a quarterly forecast report from Hotel News Now parent company STR and Tourism Economics.

Canada experienced an 11% increase in inbound travel during 2016 (the most since 2002), which fueled a 5% increase in revenue per available room to 96.16 Canadian dollars ($72.20). A total of 73% of Canada’s inbound arrivals came from the Americas, which dwarfed the shares of inbound travel from both Europe (14%) and the Asia/Pacific (11%). Inbound travel is expected to increase again in 2017 from 20 million to 21 million, which is expected to contribute to a 4.2% increase in RevPAR. Canada’s GDP is also expected to grow 2.2% in 2017, according to forecast by Oxford Economics, after expanding 1.4% in 2016.

*Note: RevPAR and ADR are in local currency (CAD)

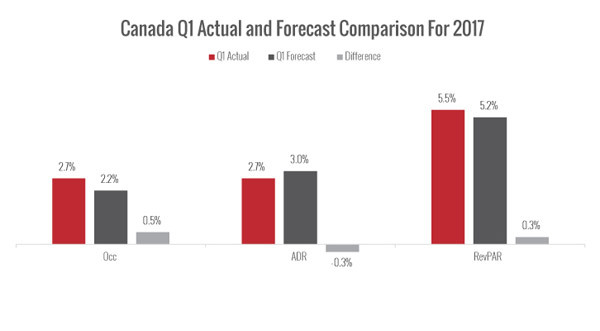

Canada performed well during the first quarter, when RevPAR grew 5.5%. Actual RevPAR growth surpassed forecasted RevPAR by 0.3%. The chart above illustrates the differences between actual and forecasted key performance indicators for the first quarter of 2017.

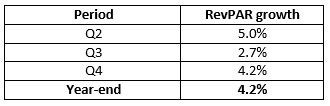

Average daily rate will carry a larger share of the RevPAR mix throughout the rest of the year. Year-end estimates from STR and Tourism Economics project a 3.6% gain in ADR compared to a 0.6% increase in occupancy. The table below illustrates the 2017 forecasted RevPAR growth broken down by quarter:

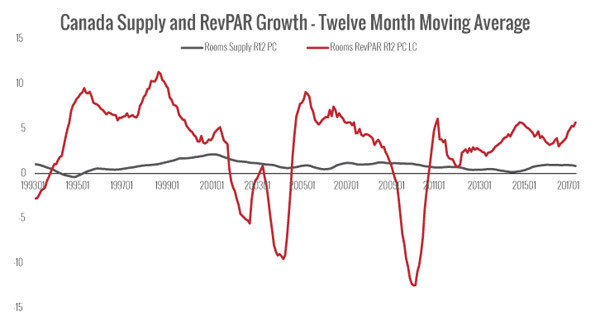

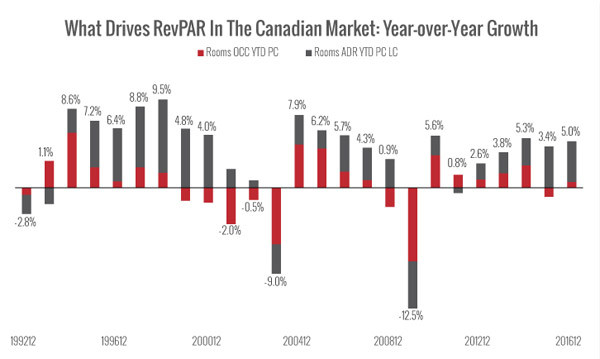

Canada’s recent strong showing mirrors performance historically. During the past 25 years, the country has suffered only three major periods of decline in demand that resulted in significant drops in both ADR and RevPAR. After the most recent downturn, Canada’s demand rebounded in late 2010 which has led to RevPAR trending positively since.

*Note: RevPAR is in local currency (CAD)

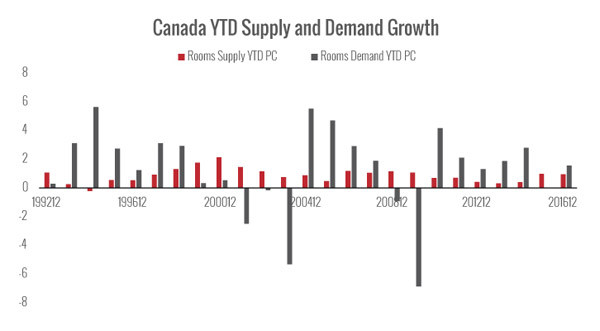

Canada’s demand growth largely has outpaced its supply growth, which has yielded relatively sustained increases in occupancy. From 2010 to 2014, for instance, demand outperformed supply. During 2015, supply growth of 1% outpaced sluggish demand growth of 0.2%. Demand rebounded in 2016 with a 1.6% year-over-year increase compared to supply growth of 1.0%.

RevPAR has recorded year-over-year growth since 2010. On average, ADR drives RevPAR growth more so than occupancy. For the past five years, ADR growth, on average, has contributed more than 50% to RevPAR growth year over year. The chart below illustrates the composition of ADR and occupancy changes in RevPAR growth since 1992.

*Note: ADR is in local currency (CAD)

Market focus: Montreal, Toronto and Vancouver

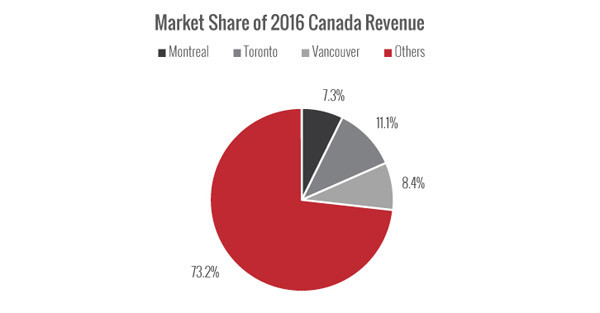

On a market-level basis, Toronto contributed 11.1% of rooms revenue, the highest share in Canada by market in 2016. Vancouver (ranked fifth out of 16 markets) represented 8.4% while Montreal (ranked seventh out of 16 markets) recorded a 7.3% share of Canada’s rooms revenue for 2016. The remaining 13 markets contributed a combined total share of 73.2%.

*Note: Rooms revenue is in local currency (CAD)

STR and Tourism Economics conducted further analysis of the three markets to discern their performance during the first quarter. Montreal recorded RevPAR growth of 13.5%, driven primarily by an 8.9% surge in occupancy. Toronto’s RevPAR increased 6.9%, which fell short of the forecasted figure of 8.6% due to lower-than-expected occupancy. Vancouver brought up the rear with RevPAR growth of 4.6%, which fell short of its forecasted figure of 5.4%.

STR and Tourism Economics forecast positive growth in RevPAR for these markets and Canada as a whole for the subsequent quarters in 2017.

Previous:Hotels working to reduce food waste in new, novel ways

Next:LIIC: As GDP goes, so goes the US hotel industry

Hot key words

Hot Products

Popular Vendors