✕

Column: industry Tag: Extended-stay segment,extended-stay hotel Published: 2017-09-27 13:35 Source: Author:

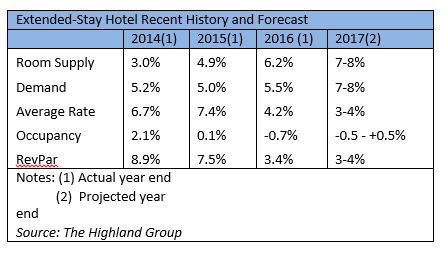

ATLANTA—Despite opening a record number of new rooms, strong extended-stay demand growth is keeping occupancy at high levels and providing strong fundamentals for real revenue-per-available-room growth in near term.

About 30,000 new extended-stay hotel rooms opened between mid-2016 and mid-2017, which is a 9% increase over the previous peak at mid-2010.

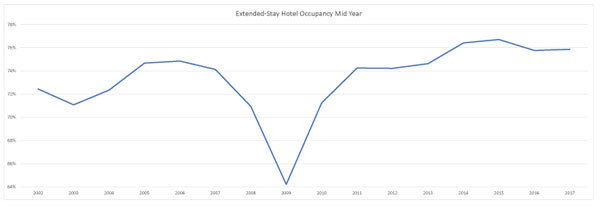

Over the last four years, despite 80,000 new rooms increasing supply by 23%, extended-stay occupancy has stayed around 76%.

During the previous peak period between 2005 and 2007, extended-stay hotel occupancy reached a high of 74.9% and stayed above 74% for three years before dropping more than 3% in 2008. Extended-stay average occupancy at mid-year 2017 has been above 74% for seven straight years and higher than 75% for the last four.

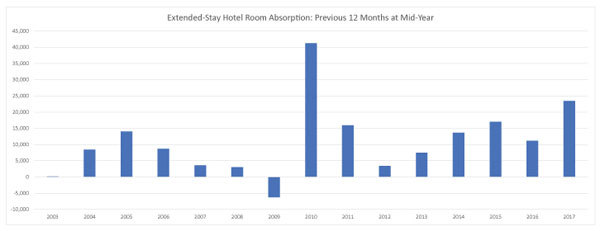

Excluding the 2010 recession recovery year, extended-stay hotels have reported some of the strongest gains in demand since the 1990s when room supply was about one third of its current level. Annual extended-stay demand growth was about 5% from 2014 to 2016 before climbing above 7% by mid-2017. Furthermore, during the previous cyclical peak extended-stay demand growth decelerated, but in more recent years the trend has been upward.

The upward trend in demand growth coupled with a larger base of rooms has resulted in record levels of extended-stay room absorption. Excluding the 2010 recovery year, mid-2017 was a high point with more than 23,000 additional rooms occupied compared to mid-2016.

The absorption of extended-stay rooms has increased substantially during the current cycle. The average annual absorption of rooms between 2015 and 2017 was more than 23,000 compared to fewer than 10,000 from 2005 through 2007.

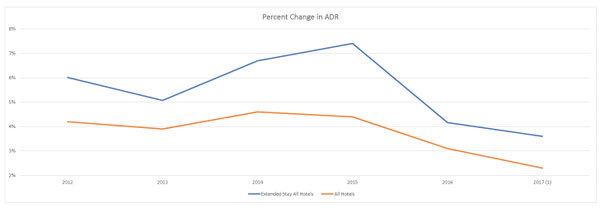

Despite much greater supply growth than the overall hotel industry, maintaining high occupancy has enabled extended-stay hotels to increase average daily rate faster than all hotels.

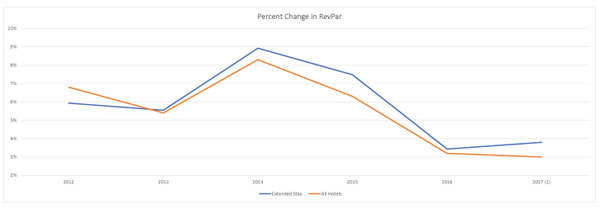

Compared to all hotels, the annual increase in extended-stay hotel RevPAR has been greater in most years since 2012.

Very unusually for this stage in the cycle, the pace of RevPAR growth at extended-stay hotels increased over the last two quarters while overall hotel RevPAR growth declined slightly.

The segment’s strong performance has led to a rapid rise in new construction which approached a record 50,000 rooms at mid-2017.

The annual performance of extended-stay will depend largely on two things: How quickly rooms under construction actually open and the effects of the recent severe weather. Hurricane Katrina boosted the extended-stay segment in 2006 and 2007, particularly the west south central and south Atlantic regions, which account for more than 30% of extended-stay room supply. It is too early to predict the impacts of devastating weather on the hotel industry. but the near-term outlook for extended-stay hotels is very good.

Previous:Silverton Inn, Silverton, Oregon, Sold by Crystal Investment Property, LLC.

Next:Home2 Suites by Hilton Dickson City Scranton Opens in Pennsylvania

Hot key words

Hot Products

Popular Vendors