✕

Column: industry Tag: hotel industry,hotel performance,Americas Published: 2017-08-25 13:52 Source: Author:

STR’s Patricia Boo shared hotel performance and pipeline information from Latin America and other Americas markets outside the United States at the Hotel Data Conference. (Photo: Event Coverage Nashville)

NASHVILLE, Tennessee—While growth in the hotel industry is happening around the globe, different geographic regions are dealing with a variety of issues having direct and indirect impact on hotel performance and pipeline. In the Americas outside of the United States, foreign exchange rates, tourism trends and supply issues are playing particularly large roles.

Three speakers at the recent Hotel Data Conference examined the factors influencing hotel performance and pipeline in the Americas regions outside of the United States in a discussion titled “Winds of change in the Americas.”

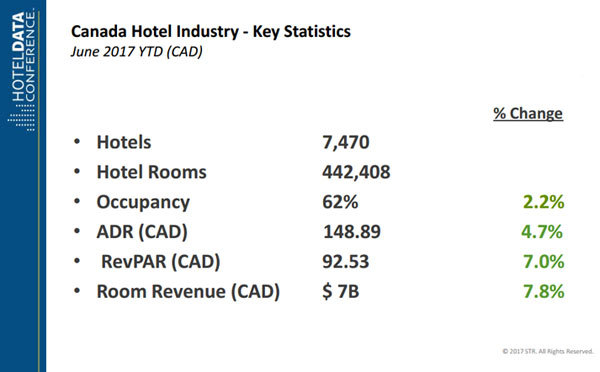

Canada: High demand, good exchange rates

(Slide: STR)

Across the board, Canada’s hotel industry is experiencing growth in all key performance indicators. Year to date through June, the country saw occupancy grow 2.2% to 62%, while average daily rate in Canadian dollars rose 4.7% to CA$148.89 ($118.71) and revenue per available room rose 7% to CA$92.53 ($73.77).

Fatima Thompson, associate director of business development, hotels, for STR—parent company of Hotel News Now—said the current favorable exchange rates are a big driver of tourism in Canada.

“When we look at performance in key Canadian markets like Montreal, Ottawa, Toronto and Vancouver, we’re seeing growth in all of them,” she said. “People are going to Canada because of that exchange-rate factor.”

Ingrid Jensen, manager of strategic market planning and feasibility for InterContinental Hotels Group, said the country’s 150th anniversary celebration this year also helped tourism, adding to favorable exchange rates and a generally favorable outlook on the country.

“We need to remember that, apart from the exchange rate, Canada continues to be perceived as a safe destination, a stable environment, both politically and economically,” she said. “That helps promote travel to Canada.”

Thompson shared Canada’s pipeline snapshot, showing 60 hotel projects and 9,056 rooms in construction, 67 projects and 7,872 rooms in final planning, and 56 projects and 6,145 rooms in planning. Altogether, the country’s active pipeline as of June includes 183 projects comprising 23,073 rooms.

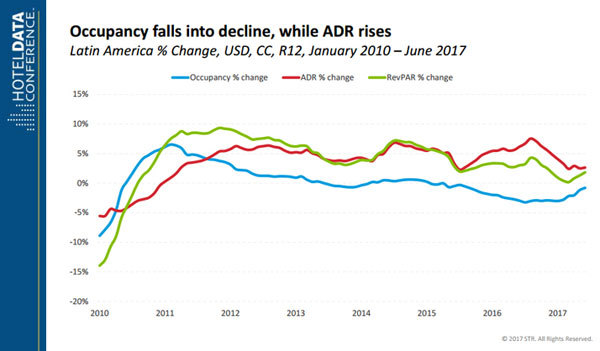

Latin America: Instability’s effects

(Slide: STR)

“We talk about Canada being a stable market, but when we look at Latin America, the best word I can think of is ‘uncertainty,’” said Patricia Boo, area director for Central and South America for STR.

The key factors contributing to that instability include oil prices, exchange rate and political instability, she said.

The region has suffered several natural disasters over the past few years, including earthquakes and flooding.

“The good news is that travel and tourism are growing,” Boo said. “Particularly Central and South America show some increase in international arrivals, and Chile has seen a 26% increase in international arrivals.”

She said since this region is so politically splintered, travel between countries is often done to take advantage of better retail conditions.

Supply is an issue across the region, Boo said, leading to overall occupancy declines despite the growth in travel and tourism.

“Demand isn’t picking up at the same pace, … and what’s really driving RevPAR is ADR,” she said.

Across the entire Central and South America region, KPIs show mixed results. ADR is down 3.1% year to date through June (in U.S. dollars), occupancy is down 0.3% and RevPAR is down 3.3%. Demand is up 2.5%, but not enough to outpace the 2.8% supply growth in the region.

Brazil leads the region’s pipeline by room count, and total pipeline numbers show 58,925 rooms in the active pipeline, with 28,103 of those in construction, 11,107 in final planning and 19,715 in planning.

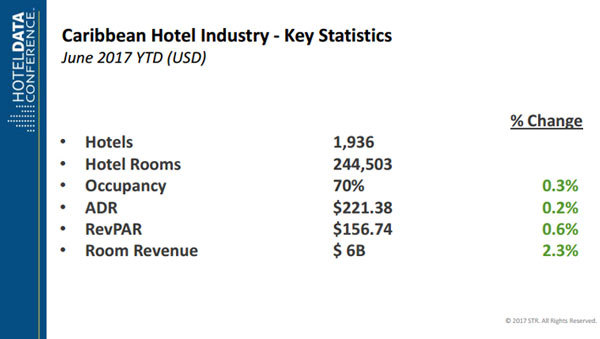

Caribbean: Resorts bounce back

(Slide: STR)

The Caribbean’s small growth patterns indicate a region coming off a difficult year, Thompson said.

“Last year, Zika was the big subject, and it affected the area tremendously,” she said. “At the end of the year, the region had to deal with Hurricane Matthew.”

Year to date in June, all KPIs were showing growth, but at very small amounts—occupancy up 0.3%, ADR up 0.2% and RevPAR up 0.6%.

Resorts are driving both performance and the pipeline in the Caribbean, Thompson said. The region’s resort year-over-year occupancy grew 71% year to date through June 2017, compared to the same period in 2016.

The three largest projects in the Caribbean’s active pipeline are resorts: The 730-room Royalton Bavaro Resort in the Dominican Republic, the 850-room Palladium Hotel Grand Jamaica Resort & Spa in Jamaica and the 2000-room Celebration Jamaica Resort & Casino in Jamaica.

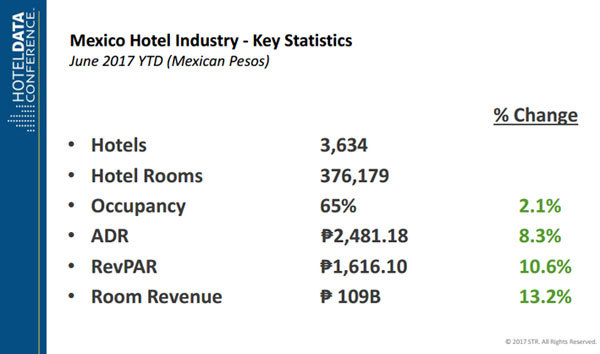

Mexico: Still popular despite worries

(Slide: STR)

“The devaluation of the peso is a big story in Mexico, and that is benefiting the industry tremendously,” Thompson said. “Also, there was uncertainty at the beginning of the year with President Trump … and how the relationship between Mexico and the U.S. would affect tourism.”

So far, Thompson said Mexico hasn’t seen measurable hits to tourism because of that.

“People are going to Mexico and they definitely are taking advantage of exchange rates,” she said. “We’re seeing it in key performance indicators. We’re seeing double-digit (growth) in RevPAR—that says Mexico continues to be a very popular destination.”

ADR and RevPAR (in Mexican pesos) across all the country’s major regions have shown positive growth year to date through June. Countrywide, Mexico has seen 10.6% RevPAR growth and 8.3% ADR growth.

Jensen said IHG notices particular demand growth in certain regions of Mexico—notably Central Mexico—driven by the growth of the automotive industry. The company has 1,500 rooms in its Mexico pipeline, driven by its Holiday Inn and Holiday Inn Express brands, along with several extended-stay projects, she said.

Previous:The Hotel Industry in the Central/South America Region Reports Postive Results for July 2017

Next:Lodging experts on trends affecting the hotel industry

Hot key words

Hot Products

Popular Vendors