✕

Column: industry Tag: oil prices,hotel demand Published: 2017-08-30 10:20 Source: Author:

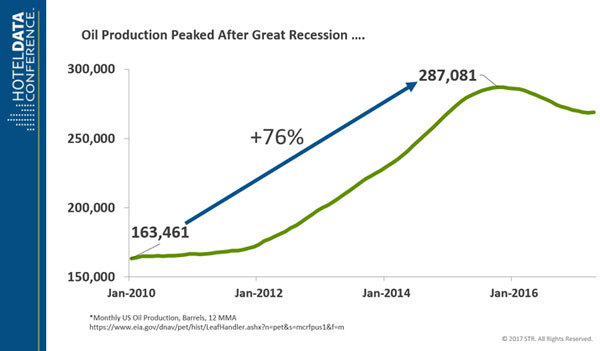

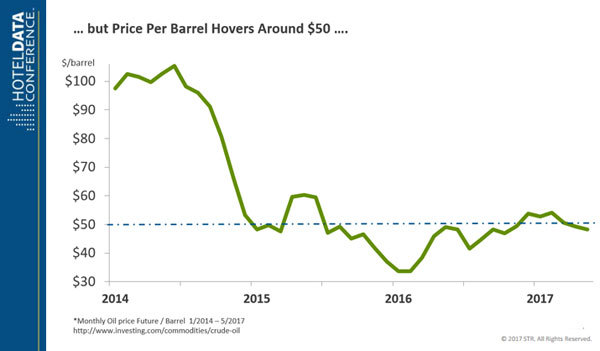

NASHVILLE, Tennessee—As the oil future price hovers around $50 per barrel, oil-dependent submarkets are facing continued slow performance. Between 2010 and late 2015, oil production in the U.S. increased 76% to 287,081 barrels per month, annualized. In early 2015, the oil price future per barrel dropped to around $50 and has not recovered since then to its earlier high of more than $100 per barrel.

This article is based on a presentation given at the Hotel Data Conference earlier this month.

(Slide: STR)

(Slide: STR)

(Slide: STR)

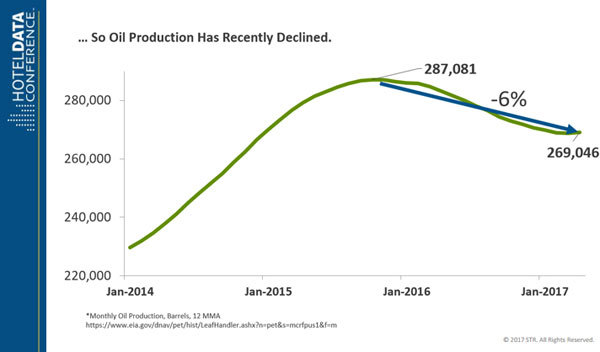

Not surprisingly, oil output recently declined to just under 270,000 barrels, annualized.

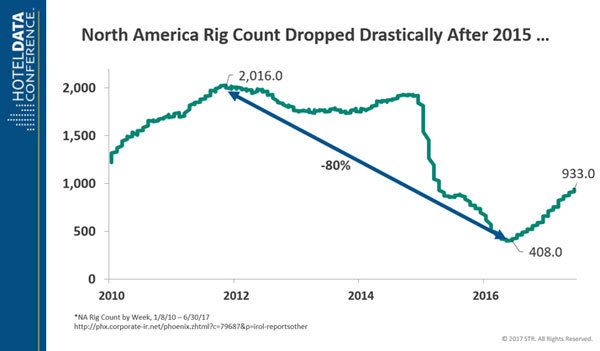

What drives room demand in oil-dependent submarkets is also the rig count, as published by Baker Hughes. With lower oil prices and decreasing production, there is less need for new oil rigs, and the rig count has drastically decreased.

(Slide: STR)

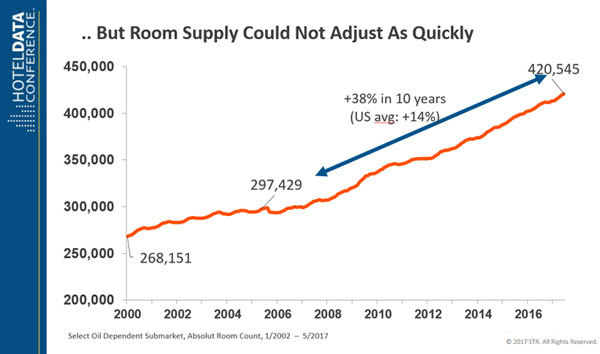

Lately, it seems that the count has rebounded slightly, but it stands nowhere near the prior peak of more than 2,000 rigs. As demand increased and rigs were deployed, hotel developers were eager to capitalize. Supply numbers increased dramatically, but could not be adjusted as quickly as rig counts, so room supply numbers continued to increase even after demand numbers declined.

(Slide: STR)

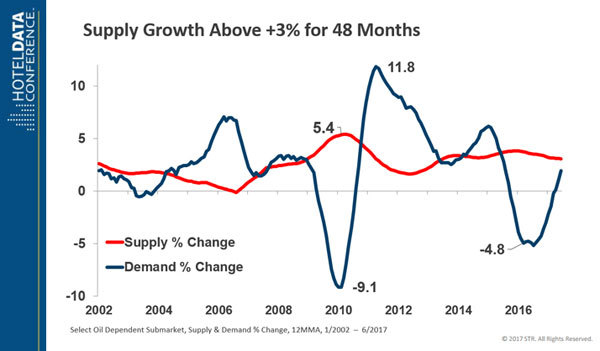

Supply growth over the last few years stayed relatively stable—at a high level—while demand changes gyrated as macroeconomic influences kept oil price increases at bay.

(Slide: STR)

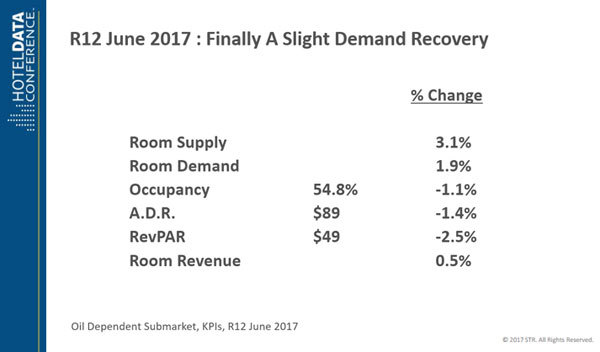

Room demand dropped in the aftermath of the great recession and, most recently, as oil prices did not recover. At the same time, room supply increases stayed relatively steady at the very high level of 3%. Keep in mind that during the same time the total U.S. supply change dropped to around 0.5% growth and today stands at around 1.9% growth. This combination then lead to steep occupancy and average daily rate declines from which the submarkets are only now just recovering.

(Slide: STR)

Most recently, room demand increased again, and that bodes well for the future. Of course, occupancy is still declining since new rooms are opening much faster than the demand can recover. It is a bit disconcerting to observe a total occupancy of just under 55% on an annual basis while at the same time the pace of openings seems to not slow down.

Predicting the performance of oil-dependent submarkets is historically difficult since so much depends on the price of oil and the incentive to open new drilling locations. So, if you think that oil prices will recover over, say, $70 per barrel, a demand recovery is probably also in the cards. Likewise, if the oil price stays around the current level, new drilling rigs are probably not economical, and related room demand will continue to be depressed at current levels.

Previous:Best Western Premier Sonasea Phu Quoc in Vietnam Announced for 2019

Next:Hyatt expands wellness offerings with Exhale buy

Hot key words

Hot Products

Popular Vendors