✕

Column: industry Tag: Nordic hotel,Nordic hotel industry,hotel industry Published: 2017-12-20 13:36 Source: Author:

On stage at the NHC-Conference are Riikka Moreau (left), of The Ascott Limited; and Lisa Neubueser, from Zoku International. (Photo: NHC-Conference)

COPENHAGEN, Denmark— Hotel industry experts expect continued growth in the Nordics, and there is widespread sentiment that demand is particularly strong for extended-stay products and affordable luxury hotels.

Delegates at the 2017 NHC-Conference on hotel investment and development in the Nordics offered their insights via a survey into the current state of the region’s hotel market and what we can expect from the future.

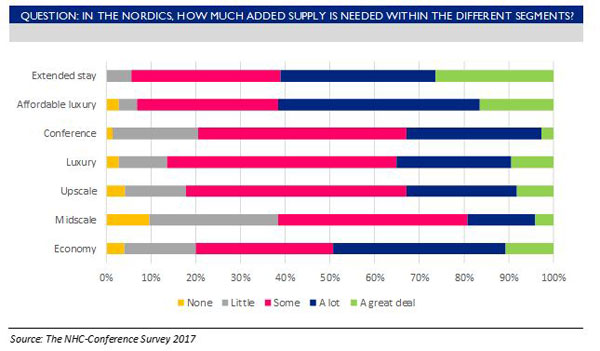

The results of the NHC-Conference survey revealed that in 2017, 73% of the delegates considered themselves likely or indeed very likely to expand their hotel presence in the Nordic region within the next five years. What type of supply can we then expect to see more of in the future?

Traditional, medium-sized, 3- and 4-star hotels with meeting facilities and a discrete design element is, with a few deviations, the classic and well-appreciated Nordic hotel profile. However, as is also the case in other regions and industries, the Nordic hotel scene is undergoing increased diversification, due to new market “disruptors,” leading demand in the direction of more affordable luxury concepts and extended-stay accommodations.

Several of these disruptors are focused on shaking up the extended-stay sector, including in the Nordics, where our survey found it to be the sector with the highest growth prospects.

“There is a lot of un- or misaccommodated demand for extended-stay accommodation in the Nordics using the current hotel supply, which may not be perfect for what they need,” said Lisa Neubueser, senior global rollout at Zoku, during a panel discussion about the sector.

Riikka Moreau, senior manager of real estate investment trust The Ascott Limited, agreed there are demand opportunities in the Nordics.

“It is ambitious and unnecessary to create new demand in the region,” she said. “There is already a lot of demand for extended-stay products in the Nordics, but people are now using hotels or corporate housing, due to a lack of supply.”

Consequently, operators and investors alike are eager to enter the market.

Moreau further highlighted her company’s interest in the region by explaining that “Ascott Limited’s primary role is as property investor, but there is very little apartment hotel stock to be bought in Scandinavia. We would have to be extremely lucky with development projects, if we go down the investment road. After very long internal discussions, we are open to sign operational leases in order to get in to the market and gain brand presence.”

As the survey results clearly indicate, “affordable luxury” is a concept currently receiving massive attention in the Nordics.

During a discussion about the essence of affordable luxury, panelist Meindert Jan Tjoeng, director of development and investment at CitizenM Hotels, explained how his company approaches the idea.

“We create upscale hotels on half of the normal square meters and with half of the staff, but where the guests still very much recognize the quality of the service,” he said. “The personal touch is always very important. The CitizenM concept focuses on what really matters to the guests.”

Investors are also interested in affordable luxury, because many of these concepts are considered realistic, clear and smart, sources said. It fits well with the cool, efficient style of Nordic hospitality, which due to high salaries, needs to be smart. Furthermore, the design aspect, in which Northerners feel at home, combined with the idea of providing down to earth and relevant “luxury,” agrees with the Nordic mindset.

Combining new and relevant luxury with a lower room rate, which is what affordable luxury concepts do, has echoed all over Europe—in fact, the whole world. However, some markets are more suitable than others, panelists said.

“We want to go to markets where the (average daily rate) spread between luxury and budget is attractive,” said Isabell Hajdukiewicz, group director of development at Ruby Hotels. “This is also why we are not currently focusing on the eastern part of Europe, where 5-star luxury hotels are considerably affordable.”

She added that Ruby Hotels has Copenhagen and Stockholm on its “wish list” for development.

Copenhagen and Stockholm are stealing the show

While the Nordics are capturing attention from regional and international players there is, not surprisingly, a focus on the capital and large secondary cities, especially among those players that have yet to plant a flag in the region. However, some of the five capitals seem to be receiving more attention than others.

Our survey showed that Copenhagen and Stockholm are the most attractive when it comes to new development. In fact, 88% of respondents consider Copenhagen attractive or very attractive. In the case of Stockholm, the figure is 81%, split evenly across those who find it attractive and very attractive.

Among the qualities that make these markets attractive to developers is that they are bigger markets where it is possible to open more than one hotel, which is a priority for many players.

Interestingly, it is the cool destination of Reykjavik, Iceland, that seems to be falling behind in terms of attractiveness, despite showing significantly higher revenue-per-available-room growth and level compared to other capitals in the region. There are multiple explanations for this, including the fact that it is a small market with a combined supply of 4,700 rooms. It would be difficult to open more than one of the same hotel brands, and this limited expansion potential holds many back. In addition, the Reykjavik hotel landscape is dominated by national players, and it can be hard for outsiders to penetrate the market.

Can we expect sustained growth?

Where does the expectation of continued growth come from? Perhaps it’s easy to get used to good times, and the sun has certainly been shining on the region in recent months and years. However, the bulging pipelines the rosy times have created mean that significant new room supply must be integrated into the markets.

While some cities are relatively modest with their new supply, including Oslo, Norway, and Helsinki, Finland, Copenhagen and Stockholm have bursting pipelines that might lead to, at least for a while, stagnant or even falling KPIs, which might subsequently put downward pressure on hotel leases. However, the two cities have strong foundations and demand is unlikely to slow down.

Naturally, the key to a sustainable growth is diversity in the forthcoming supply. Thus, a change of gears and a new focus, for example, on extended-stay accommodation and lifestyle products, is important in order to ensure balanced markets.

Previous:Auberge Resorts Acquires Telluride's Madeline Hotel and Residences

Next:Potential for Manhattan ADR gains sparks muted optimism

Hot key words

Hot Products

Popular Vendors