✕

Column: industry Tag: soft brands,indie hotels,soft-branded hotels Published: 2017-10-19 13:53 Source: Author:

REPORT FROM THE U.S.—As guests continue to seek out unique experiences during their travels, hotel companies have capitalized on a growing interest in independent hotels through the introduction and proliferation of soft-brand collections.

Hotel News Now reached out to owners and managers of independent hotels and soft-branded properties to collect their thoughts on the growth of soft-brand collections and what impact they will have on the independent hotel space.

What do you think of the number and types of soft brands currently out there?

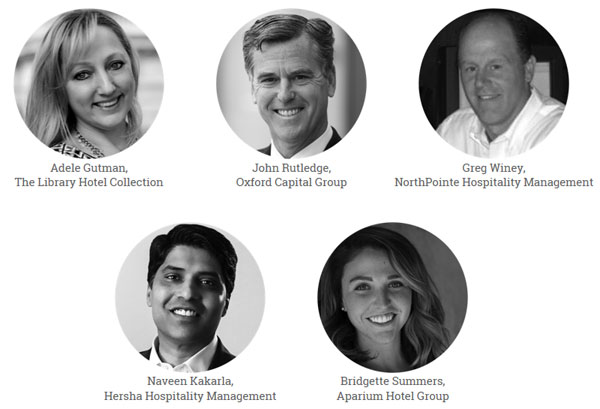

Adele Gutman, VP of sales, marketing and revenue, The Library Hotel Collection

“I love that the Library Hotel Collection is independent and that we control our own destiny, our expenses, and our guest experience 100%. We work very hard, and with great passion, so we prefer, as much as possible, to enjoy the full benefit of our profits. We have investigated many soft-brand offers which have come our way, but we have not seen a fit in terms of the price/value relationship. One day that may change, but for now we are fortunate to be very successful on our own. For our European hotels—Aria Hotel Budapest and Aria Hotel Prague—as well as our upcoming Canadian property—Hotel X Toronto—we recognized that we can benefit from an extended global reach. Strictly for sales support, we work with Global Hospitality Services, which has a simple monthly fee, and optional opportunities that we can participate in at our discretion. We hire them for their work and support, not for a posh brand name. We have our own brand.”

John Rutledge, founder, president and CEO, Oxford Capital Group

“Clearly the big chains recognize the dramatic growth in the lifestyle/boutique sector. They recognize that a larger percentage of the population like a more unique, design-forward, independent, more bespoke experience and don’t want conventional cookie-cutter, vanilla kind of product uniformity. They’re recognizing that growth, and they’re saying, ‘We want to be a part of it.’ Secondly, and in parallel with that, the reality is many of the big chains have extensive penetration in many of the major markets. In order for them to continue to grow and grow earnings per share and grow their stock prices … part of that growth is we can further slice the demand segmentation in an even narrower line to include soft brands.”

Greg Winey, president and CEO, NorthPointe Hospitality Management

“I think the motivation to create soft brands has been extraordinarily compelling over the past five-plus years as it relates to the number of independent and unique hotels in each market. The challenge in my mind is simple brand differentiation. The consumer is flooded with constant messaging regarding the newest, latest and greatest ‘millennial’ hotel. The fact is, boutique hotels are now becoming mainstream. The real question will be how the 600-pound gorillas (mainstream brand hotels) don’t get eaten by their young (boutique brands). The brands will have some real challenges regarding ‘vanilla’ hotels and the need to make each stay in each venue unique as guests continue to migrate to boutique hotels.”

Naveen Kakarla, president and CEO, Hersha Hospitality Management

“We are reaching the tipping point beyond which it will be hard for consumers to connect with too many more hotel brands. That said, the ‘non-brand’ or ‘brand of one’ is arguably the fastest-growing segment in many urban markets for smaller, neighborhood hotels that cater to lifestyle travelers.”

Bridgette Summers, director of hotel development, Aparium Hotel Group

“It seems as though every major chain is going all-in with soft brands to stay competitive and relevant to today’s traveler. At every conference, someone announces a new soft brand—it seems to be a quick and relatively easy way for established brands to grow and scale in a ‘unique’ way. Developers seem to like the flexibility and deregulation of brand standards powered by the engine of the big brand. That being said, the space is definitely getting crowded, and I think product has become muddled. Consumers likely won’t be able to differentiate between the various brand experiences. Honestly, it’s gotten to the point where it seems a bit contrived and reactionary.”

Is there room for more soft-brand collections?

Gutman: “I think there is definitely an opportunity for a brand that can enter the market with an experienced and hardworking team, comprised of select hotels which fit the brand-quality promise. As it stands, however, some soft brands demand that hotels conform to their brand practices and participate in their marketing programs, while neglecting the importance of a high level of guest satisfaction. There is certainly room for a company ready to charge a more modest monthly fee or only charge for reservations produced. The moment you add mandatory advertising contributions or mandatory GDS fees, you are paying commissions for business you have actually secured yourself. I want to spend my resources on creating a unique and wonderful guest experiences. I don’t want to spend it on paying people who don’t put in the same effort as my on-property team … (or on) mandatory fees and expenses that don’t enhance the guest experience. Like OTAs, sure soft brands can be helpful, but at what cost?”

Rutledge: “It’s getting pretty crowded. The big chains, the big brand families, at this point have 15, 20, 25, whatever brands, whether it’s Hilton, Marriott or Hyatt. It’s hard to imagine it getting sliced and diced dramatically further. With that said, I’m sure there will be at minimum some incremental growth in soft brands, further segmenting the markets.”

Winey: “The industry is now softening and has gone through its typical cyclical, decade-long cycle (although the Great Recession may be a once-in-a-lifetime event). The consumer will decide this question, but no doubt, (in my opinion, it’s) not a good time to stick a toe in the water.”

Kakarla: “Yes, for the largest brand companies, there is room to add inventory to their shelf through soft brands. In fact, soft brands also have the potential to outgrow their core branded peers, given the flexibility soft brands allow to be unique and local with their programming.”

Summers: “I don’t think so, but that doesn’t mean we’re going to stop seeing new soft brands in the market. What’s interesting is that soft brands are starting to cross segments. Once predominantly positioned in the 4- to 5-star/upscale and luxury segments, now product is coming to market in the 3-star/midscale space. I think a soft brand that plays in the economy or extended-stay categories could be a differentiated enough experience to be impactful—maybe we’ll start to see more of those.”

What effect have soft-branded hotels had on the fully independent hotel space?

Gutman: “I think many people get into the independent boutique hotel business because they think it is good way to use their real estate investment, or they think it will be exciting and glamorous, but they may not have the experience, expertise, and confidence to go it alone. To a new hotelier, paying heavy fees for a luxurious soft brand name may seem like a worthwhile insurance policy. As small independent hotels become more and more plentiful, they are an easy target for soft brands looking to grow their base. These hoteliers need to be careful and choose wisely to ensure their soft-brand choice will deliver more help than hype, and that there is an exit clause if they turn out to be eating more profits than they are producing.”

Rutledge: “I think they’ve had an impact in that there are maybe plenty of hotel owners, investors, developers who may say they prefer the independent space. And I think a growing percentage of the traveling public has a preference for the independent space. But I can have my cake and eat it, too. I can have an independent, very uniquely designed and positioned asset with a name that’s unique and positioning that’s unique, but I can plug it into one of the big-chain engines, the reservation machines and tap into their loyalty programs. I can get a little bit of the best of both worlds. … On the other hand, my instinct says it’s becoming more competitive for some of the independent-branded hotels. They’ve got to compete with some of the big chains who are offering that independent, less cookie-cutter approach. … You have to conclude you can have a significant jump in revenue per available room to justify encumbering your asset with a long-term franchise agreement and pay an additional 8% to 14% in incremental fees.”

Winey: “I think it’s become a big challenge. Look at what’s predictably going to happen in Europe with soft-branding amazing, century-old buildings. The independent innkeeper must work extraordinarily hard to find a customer and keep a customer. When you have the brand machines (like Hilton, Marriott and IHG) behind you, you immediately get the impact of some 50 (million) to 60 million-plus loyalty members. That’s really hard to compete with when it comes to cost of customer acquisition and retention.”

Kakarla: “Consumers have more choice and are able to rely on hotels from a consistency standpoint, able to expect even more on the design and positioning side than they have gotten in the past from some of the core brands.”

Summers: “Soft brands definitely create more competition in the market for independents. You have product that looks independent where previously it likely would have been developed and operated under a traditional flag. What that means is that design alone is not enough of a differentiator anymore. The experience of the independent hotel must be holistic and true to the market, thus creating loyalty among locals and generating important repeat, direct business. In a way, the soft brand has forced the evolution of the independent hotel. Our Foundation Hotel in Detroit is a prime example of true independence. We have over 40 local artisans, makers and craftsman contributing to the guest experience. We have one of the most accomplished chefs to ever come out of Detroit making approachable yet elegant food for the community. The property is so much more than a hotel—it has quickly become a part of the fabric of the city.”

What do you consider to be the difference between an independent collection and soft brands?

Gutman: “As an independent collection, the Library Hotel Collection makes every decision based on what’s profitable for our hotels and best for our guests, because we have an ownership approach, and everyone on our team cares deeply about our business. A soft brand cares about its own business making money first and foremost. If you really are not sure how to market your hotel, if your attention is focused on other investments, or you feel that the challenges at your hotel are more complex than what you feel able to handle, a soft brand may be very helpful for you and worth the investment. For us, however, we are professional hoteliers and feel we can invest those dollars more effectively within by cultivating our own passionate, creative and business-savvy team to achieve our goals.”

Rutledge: “The independent collection has some real appeal in its uniqueness. It does not have access to one of the big-brand engines, the big-chain engines and their loyalty programs. Nor does it have to pay for that.”

Winey: “Mainly, the brand standards and the loyalty programs. Personally, I believe the brands have done an exceptional job allowing independent ‘soft-branded’ hotels to keep their character and independence while at the same time mandating high standards. As mentioned, the loyalty programs are the silver bullet that is the game changer for soft brands.”

Kakarla: “I expect soft brands to have a bit more consistency than an independent collection, which is more about taste and quality, as well as individualized experiences, than service levels or consumer offerings.”

Summers: “The true difference is in the holistic guest experience, and that starts with service and people. The success or failure of a property will ultimately come down to the ability of the management company to empower associates to create that independent experience for guests. With a soft brand, you run the risk of having an operator take a big-brand approach to service. The result is a property run with a prescriptive culture, where employees are moving through guest interactions in a transactional manner—there’s no innovation or independence in the service. Employees need to be empowered to be a part of the culture, to co-create the hotel experience with guests, and to be property ambassadors. Truly independent properties have a unique voice and a point of view—they are both a reflection of and a platform for the communities in which they operate. This creates the local loyalty which differentiates independent hotels from branded product.”

Previous:Indie hoteliers prepare CapEx budgets for 2018

Next:STR: US hotel performance for September 2017

Hot key words

Hot Products

Popular Vendors