✕

Column: industry Tag: food and beverage,revenue growth,hotel food and beverage revenue Published: 2017-08-22 13:55 Source: Author:

(Photo illustration: Annamarie Hudson)

NASHVILLE, Tennessee—To explain hotel food-and-beverage revenue in terms of a meal, catering and banquets might be the meat, hotel restaurants the side of potatoes, and in-room dining the sprig of parsley on the side of the plate. And don’t forget the drinks.

That’s because “outside of in-room dining, total U.S. food-and-beverage performance is really turning in a positive direction,” said Melissa Holm, business development executive, hotels, at STR, parent company of Hotel News Now.

Holm, along with STR Client Account Manager Allie Hanson, presented a data dive titled “Data hungry? Feast on the latest F&B trends” at the recent Hotel Data Conference.

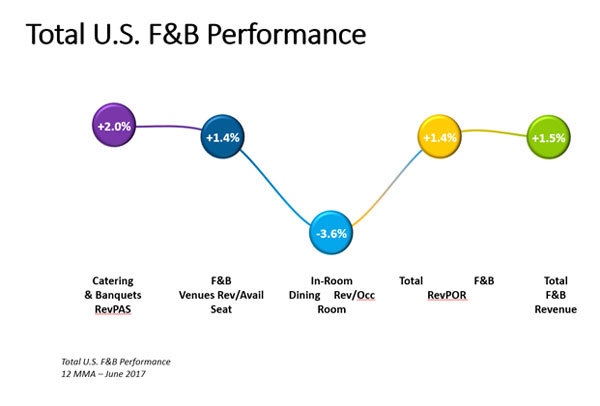

Looking at hotel F&B performance for June 2017, on a 12-month-moving-average comparison, catering-and-banquet revenue per available square foot (RevPAS) rose 2%; while for hotel F&B venues, revenue per available seat saw a 1.4% increase, according to STR data. Over the same period, in-room dining revenue per occupied room declined 3.8%. Taking all of this into account, total F&B revenue per occupied room was up 1.4% in June, and total F&B revenue overall was up 1.5%.

(Slide: STR)

Catering and banquets

Unsurprisingly, food revenue makes up the majority of catering-and-banquets revenue; broken down by chain scale in STR’s research sample, it accounted for 57% of revenue at luxury hotels, 59% at upper-upscale properties and 58% at upscale hotels. Beverage revenue accounts for another 10% of C&B revenue at luxury, 8% at upper-upscale and 6% at upscale hotels in the sample.

Among these three chain scales, only upscale saw a year-over-year drop in total C&B revenue RevPAS on a 12-month moving average through June 2017 (-0.3%). But increases in C&B revenue in the upper upscale (+2.6%) and luxury (+0.8%) chain scales lifted total C&B revenue for June by 2%.

Upscale C&B revenue was hurt most by a 4.6% decline in beverage RevPAS; food RevPAS fell by 0.7%. But beverage RevPAS exceeded increases in food RevPAS at luxury (+1.2% beverage to +1% food) and upper-upscale properties (+3.5% beverage to +3.3% food).

On average, per group roomnight, luxury hotels are seeing $158 in catering-and-banquets food revenue and $29 in C&B beverage revenue, compared to $96 in food and $12 in beverage at upper upscale and $35 in food and $4 in beverage at upscale hotels, based on the STR research sample.

Upper upscale represents “bigger hotels that host larger meetings,” Hanson said. “And the meeting planners … they want experiences to happen, so (they say) ‘Let’s incorporate food and beverage in there. … Let’s do a craft-brew taster, a wine tasting or maybe a cocktail-mixer contest or something.’ And with these trends, really in generating revenues, we’re seeing that contribution across the board.”

In upscale, “these are going to be those smaller meetings that are hosted in these hotels,” Hanson said. “They may not have the options, or even a more-limited menu. But their contribution is in other revenues: They’re taking advantage of those service charges, meeting room rentals, etc.”

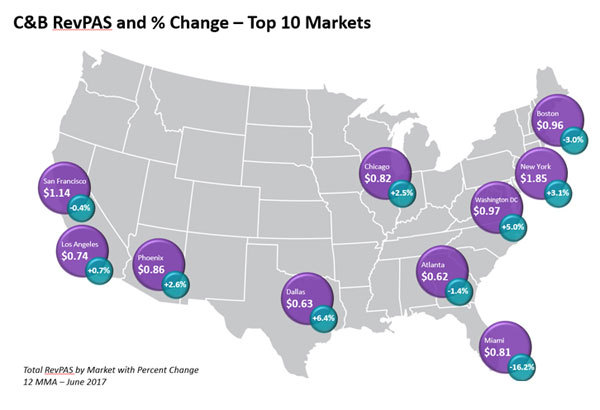

Looking at June C&B revenue at hotels in STR’s top 10 U.S. markets, on a 12-month-moving-average basis, Dallas saw the greatest increase by percentage (+6.4%), but its absolute RevPAS ($0.63) was the second lowest of the top 10.

(Slide: STR)

“Interesting fact about Dallas: They actually have the highest average square foot per property at 45,000 square feet, so they’re doing well to book more of that space for groups that have catering and banquets,” Holm said.

Miami reported the largest decline in RevPAS (-16.2% to $0.81) among the top 10 markets.

F&B venues

In hotel restaurants and other F&B venues, year-over-year total revenue per available seat on a 12-month moving average through June rose 1.4% to $44.11 in STR’s research sample.

Among the chain scales, upscale saw the only decline in revenue per available seat (-2% to $24.71), while luxury (+2.7% to $58.93) and upper-upscale properties (+0.8% to $40.61) reported growth.

Here, beverage revenue-per-available-seat growth was significantly higher for the upper-upscale segment (+3.6% to $13.95) compared to food revenue growth (+0.6% to $24.91). Luxury properties also showed significant growth in beverage revenue (+2% to $22.73), though food revenue grew by a larger degree (+3.1% to $34.70).

“Luxury and upper upscale are really increasing, especially in beverage. … In the venues, there are lot of concept changes and menu changes as well to … have a lot more options available (in beverages) … and (bring) in a lot of the local flair in these markets,” Hanson said.

In the top 10 markets, San Francisco hotels saw the greatest increase in revenue per seat at F&B venues (+5.4% to $68.10), and Miami saw the greatest decline in this metric (-11.4% to $43.23).

Trends at hotel-managed F&B venues that are driving these numbers, according to the presenters, include:

a downward shift in fine dining;

strategic use of communal space within the lobby;

taking advantage of rooftop space;

availability of healthier menu options; and

leasing of venue space to third-party restaurants.

“So these hotels have these spacious lobbies … and they’re incorporating lobby bars, just to get guests out of the rooms … and at that point, they would probably be more apt to ordering a drink or an appetizer or some food, spending a little bit more time down there, which is driving up revenues,” Hanson said.

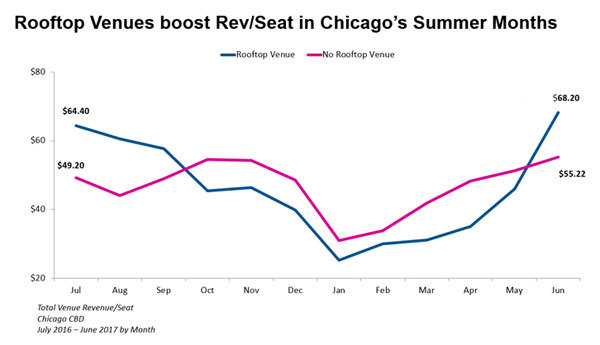

As for rooftop spaces, Holm said, a lot of urban properties are seeing a strategic advantage to converting some of it to F&B.

“Outdoor space is few and far between, and (the rooftop) is an option for that,” she said.

For example, in Chicago, properties with rooftop F&B venues had a revenue-per-seat advantage over properties without, averaging $68.20 in revenue per available seat in June 2017 compared to $55.22, respectively.

(Slide: STR)

In-room dining

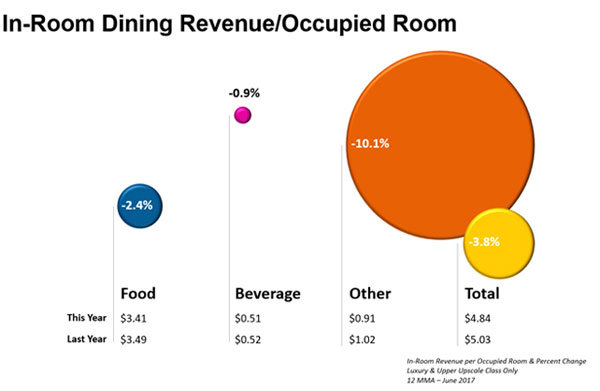

The loss eater in hotel F&B revenue continues to be in-room dining, for which STR’s research sample showed declines in food (-2.4% to $3.41), beverage (-0.9% to $0.51) and other revenue (-10.1% to $0.91) in June, compared to last year. In total, in-room dining revenue was down 3.8% (to $4.84) year over year in June.

(Slide: STR)

The presenters acknowledged that, despite the losses, in-room dining will not go away, especially at luxury properties. Some ways in which hoteliers are trying to limit the hit to revenue, they said, include:

revamping of traditional delivery methods;

·limiting of menu options;

·reduction in hours of operation; and

·concept changes to include market pantries or grab-and-go options.

Previous:Best Western Premier Historic Travelers Hotel Opens in San Antonio, Texas

Next:New supply’s pending impact on the top 25 US markets

Hot key words

Hot Products

Popular Vendors