editor:Jessie

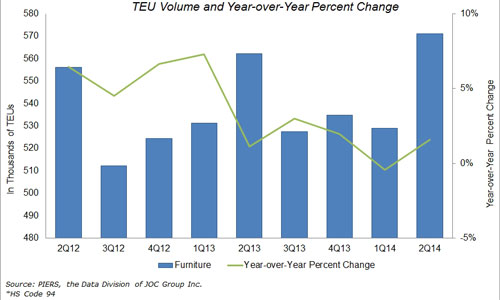

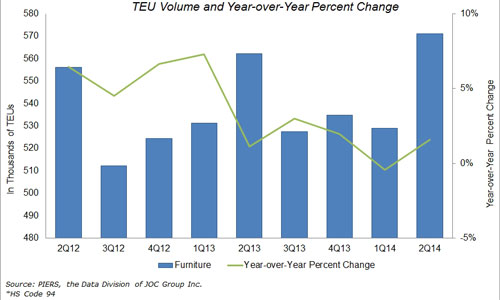

Containerized furniture imports into the United States saw growth in the first half of 2014, as a strong number of shipments in the second quarter offset weak volumes in the first quarter.

U.S. furniture importers shipped a total of 1,099,986 TEUs in the first half of 2014, up 1 percent from 1,093,514 TEUs in the same period last year, according to PIERS, the data division of JOC Group Inc.

Containerized imports of furniture into the U.S. increased 1.6 percent year-over-year in the second quarter.

Full-size chart

Containerized imports of furniture into the U.S. increased 1.6 percent year-over-year in the second quarter, following a rare slip of 0.5 percent in the first quarter, according to PIERS. Compared with the previous quarter, the first quarter saw a decline of 1.1 percent, while the second quarter witnessed a surge of 8 percent.

“Home furnishings sales in most of the country are decidedly better, especially compared to the first quarter,” Jerry Epperson, a managing director at Mann, Armistead & Epperson, wrote in the investment firm’s monthly Furnishings Digest newsletter for July.

Epperson pointed toward the improving economy to explain the better second-quarter results.

“The U.S. economy is experiencing higher levels of household formations, disposable income, home sales and employment, all of which help home furnishing sales,” he said.

June existing home sales were back above an annual rate of 5 million, a key to furniture sales and the highest level in 8 months, according to the newsletter.

“We have 2.3 million homes for sale, or about a 5.5-month supply, with a 7-month level being normal,” Epperson said. “We need more homes to be available for sale. Multi-family home construction is growing because the Millennials need apartments before they can afford first homes.”

JOC Economist Mario Moreno said in the most recent JOC Insights newsletter that new home sales improved 18.6 percent month-to-month in May and existing home sales increased 4.9 percent, in line with improved furniture sales and suggesting that the housing market is now contributing to economic growth. However, he said the outlook for home sales in 2014 still looks grim.

Furniture imports into the U.S. also might have increased in the second quarter because of seasonal demand and to avoid potential disruptions related to the July 1 expiration of the International Longshore and Warehouse Union contract.

Mike Riccio, CFO of the Michigan-based furniture manufacturer La-Z-Boy, said in an Aug. 20th earnings call, transcribed by Seeking Alpha: “Our inventory increased during the quarter in anticipation of two things. First, is the fall selling season, we want to ensure that we stay in stock and cover, as well as finished goods for our imported cases. And second, we purchased ahead due an anticipated longshoremen strike in California that did not materialize.”

China remains the top source for U.S. containerized imports of furniture.

Full-size chart

In the first half of 2014, China retained its position as the largest source of containerized furniture imports into the U.S., by far, accounting for 70.7 percent of the total, according to PIERS. That figure was down from 71.7 percent in the first half of 2013. The volume of containerized furniture imports from China declined 1 percent in the year-to-date period, according to PIERS.

Vietnam, the second-largest supplier of furniture to the U.S., increased its market share 0.8 percentage points to garner a 10.2 percent share of the U.S. market in the first half. The volume of containerized furniture imports from Vietnam jumped 9 percent year-over-year in the first six months of 2014.

The Port of Los Angeles was the largest U.S. port for furniture imports in the first half of 2014, seeing a 2.6 percentage point year-over-year increase in market share from 21.8 percent to 24.4 percent, driven by a 13 percent jump in volume. This pushed it ahead of the Port of Long Beach, which held the top position in the first half of 2013. Long Beach and the Port of New York-New Jersey each saw 1 percentage point drops in market share year-to-date to 21.7 percent and 12.5 percent respectively.

(JOC.COM )

沪公网安备31010402003309号

沪公网安备31010402003309号