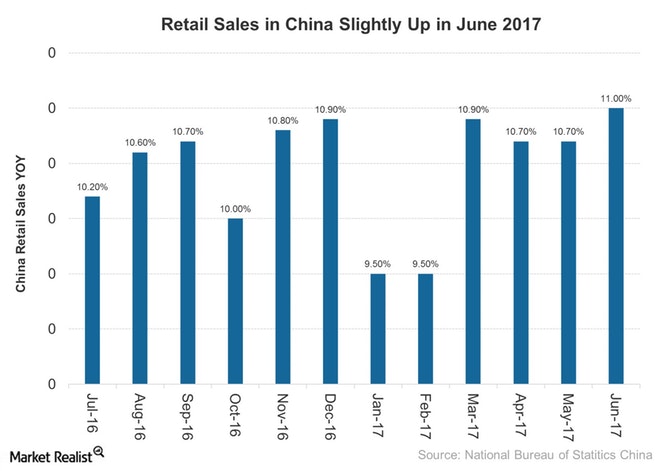

Retail sales in China

Retail sales in China (FXI) rose 11% year-over-year (or YoY) in June 2017, compared to a 10.7% rise in May. The improved performance of the retail sector provided a boost to the Chinese government’s efforts for consumption-based economic growth in the country (MCHI). The size of the Chinese market provides tremendous potential for the retail sector.

China’s (ASHR) economy grew 6.9% YoY, topping the market’s expectations in 2017. Consistent improvements in the country’s retail sales seem to have helped its economic performance so far in 2017.

China’s retail sales in June 2017

China’s retail sales in June 2017 remained above the market’s expectation of a 10.6% rise. China recorded its fastest rise in retail sales since December 2015 in the quarter. Sales surged the most for telecommunications companies (CHA) (CHU) at 18.5%, compared to 1.9% in May 2017.

Sales also rose at a faster rate for automobiles, building materials, furniture, office supplies, cosmetics, and personal care. However, sales rose more slowly than in the previous month for garments, jewelry, home appliances, and oil and oil products.

China’s online retail sales rose 41% to 73 billion Chinese yuan in June 2017, compared to 30% in the same period last year. The two biggest e-commerce giants in China are Alibaba (BABA) and JD.com (JD).

Investments

Consumer spending is highly important to the Chinese economy, considering its current transition to a demand-driven economy (YINN). China is currently focusing on a demand driven growth model, which is supported by consumer spending.

Consumption contributed 64.6% to China’s GDP growth in 2016, and it’s considered the main driver of economic growth in 2017. Investors interested in consumer-related sectors in China can consider the PowerShares Golden Dragon China ETF (PGJ) and the Global X China Consumer ETF (CHIQ). These sectors have major allocations to the consumer discretionary sector in China.

(Source: marketrealist.com)

沪公网安备31010402003309号

沪公网安备31010402003309号