Chinese e-commerce giant Alibaba opened its first cashier-free retail store, Tao Café, in Hangzhou this July. Customers can enter the store after obtaining a machine-readable QR code entry ticket through their Taobao account, and going through the facial recognition system at the store.

Customers can not only dine in the café, but also purchase various products both physically in the store and online by using interactive screens at each table. Customers pay automatically as they exit through the checkout sensor door. There are no queues at the cashier and no need for cash or even mobile payment.

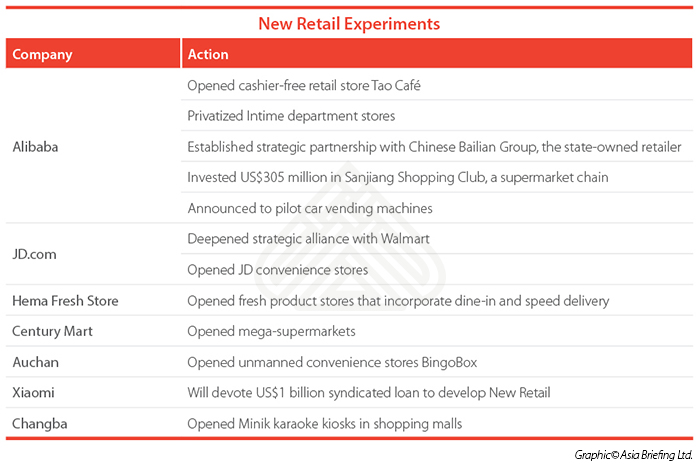

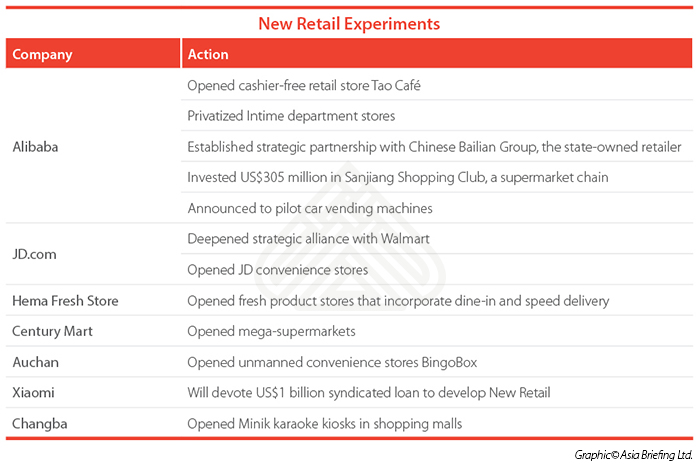

Numerous other unmanned convenience stores have emerged and expanded rapidly in recent months. The French retail group Auchan has opened dozens of BingoBox stores in Beijing and Shanghai, while F5 Future Store has opened robot-operated shops in Guangzhou.

Are we witnessing the second retail revolution after e-commerce?

This wave of automated retail stores is a part of the “New Retail” transformation of traditional retail. Jack Ma, founder of Alibaba, coined the concept New Retail last year, predicting, “pure e-commerce will be reduced to a traditional business and replaced by the concept of New Retail – the integration of online, offline, logistics, and data across a single value chain.”

If New Retail meets Jack Ma’s expectation, it will transform the retail industry and bring both challenges and opportunities to businesses. Retailers who want to stay competitive need to anticipate its impact on the traditional retail ecosystem in order to innovate, attract new customers, and generate new growth opportunities.

What is new about New Retail?

New Retail combines elements of offline and online retail, making them an integral whole.

New Retail is about bridging e-commerce, physical retail, and logistics in order to improve the efficiency of selling and buying, as well as improve the shopping experience. China is leading this revolution thanks to its strong consumer base, increasing purchasing power, preference for novel and luxury shopping experiences, and the widespread use of mobile payment.

Big Data stands at the core of New Retail. Data on consumers’ preferences, shopping habits, and sales enables efficient delivery to consumers and reduces surplus inventory– two major challenges for retail. The integration of online, offline, and logistics creates an omni-channel shopping experience, expanding the consumer base and increasing profitability.

The New Retail model comes at a time when the performance of traditional retail stores looks bleak, and e-commerce is approaching a bottleneck. Due to the rise of e-commerce, traditional brick-and-mortar retail businesses have experienced downturns. A number of foreign retailers have encountered difficulties in China, including Korea’s Lotte Mart, the US’ Walmart, Spain’s Dia Group, and France’s Carrefour, to name a few. The American consumer electronics retailer Best Buy failed to survive and shut down all its stores in China in 2011.

An interesting outlier is Costco, which partnered with Alibaba and set up its first Tmall e-commerce store three years ago, when it first entered the Chinese market. The offline and online partnership led to an exceptional US$3.5 million sales volume during Costco’s first Singles’ Day shopping festival.

Despite the popularity of e-commerce in China, its growth has begun to level off. Chinese consumers spent over US$750 billion online last year, but the growth of online retail sales will slow down as physical retail still dominates consumption.

Online platforms alone are no longer a cheap and effective means of attaining new customers. As a new model, New Retail generates new meanings for online and offline shopping.

How can traditional retailers avoid becoming obsolete?

The New Retail model poses an existential question to traditional retail players. With ever more integrated offline and online channels, brick-and-mortar retail stores simply cannot compete with New Retailers that are equipped with cutting-edge technology like artificial intelligence (AI) and possess the capacity to use data analysis for accessing more consumers.

For foreign retailers who have already established a presence in China, or are still assessing its immense retail market, the changing retail landscape means that e-commerce, digital marketing, logistics, and local partnerships are key to success.

Recruiting talents with strong digital skill sets are valuable for developing digital assets. The capability to harness multi-channel data is another great plus. Retailers should also consider partnering with online e-commerce platforms like Tmall or, alternatively, building their own dedicated websites to grow retail channels.

The most important thing to keep in mind is understanding what motivates consumers to visit physical stores and buy. Chinese shoppers nowadays are becoming more sophisticated. They are looking not only for low prices, but also at quality, brand, services, and unique or personalized shopping experiences. Customers also demand more targeted and time-efficient shopping trips. Retailers can try to diversify their products and utilize physical and digital assets to meet customers’ changing needs.

Opportunities for foreign investors

Although New Retail is still a nascent development, it possesses strong growth potential and presents a variety of opportunities. A number of investment banks – including JP Morgan, Credit Suisse, HSBC, and Deutsch Bank – recognized New Retail’s potential for boosting retail sales in recent reports. Venture capital firms, such as IDG Capital Partners, a China-focused investment firm, are looking into investing in New Retail; GGV Capital invested US$14 million in BingoBox, which is expecting to open more than 5,000 unmanned convenience stores in China by the end of this year.

New Retail can be particularly beneficial to small and medium-sized foreign vendors who want to test the market and cut costs before establishing a larger physical presence. For instance, compared with well-established traditional retailers, New Retail stores can offer a cheaper and more accessible venue to test new products for small and medium-sized producers.

For certain novel, niche, or premium products, New Retail stores can also be a launching pad into the Chinese market. High customer flows at New Retail stores will be a natural way to market products to customers.

For foreign vendors who have benefited from directly selling their goods and services on China’s e-commerce platforms, New Retail can help them develop even stronger ties with consumers and increase their market presence. As customer acquisition costs on e-commerce platforms have increased, it is crucial to develop new offline distribution channels before it is too late.

New Retail also presents an opportunity for foreign companies that specialize in technology related to New Retail, such as logistics, cloud, data analytics, AI, augmented reality, and virtual reality. Potential partnership can be established between foreign technology vendors and well-funded traditional Chinese retailers to incorporate leading technologies into New Retail stores.

Foreign investors in New Retail can benefit from government support when entering the market. The Chinese government has backed the development of e-commerce, and not surprisingly, is also very supportive of the New Retail concept. On November 11, 2016 – the same date as the Singles’ Day shopping festival – the State Council issued guidelines on the transformation of the retail industry.

The guidelines not only encourage innovation and use of new technology, but also call for more foreign investors to build retail channels in China. They recommend relevant government bodies to optimize approval processes for food and cosmetic products, simplify food inspection procedures, and enhance foreign exchange settlement to bring in more foreign companies.

Although New Retail is still at an experimental phase, it will bring tremendous change to China’s retail landscape. Foreign investors who wish to stay ahead of the game, whether traditional physical retailers, small and medium sized foreign vendors, or high-tech companies, should reevaluate their strategy, utilize physical and digital assets, and develop meaningful partnerships to meet this New Retail transformation.

(Source: china-briefing.com)

沪公网安备31010402003309号

沪公网安备31010402003309号