Online home furnishings retailer Wayfair reported strong Q2 2016 results with continued growth in its e-commerce sales and customer base.

The company operates five separate brand sites — including Wayfair, Joss & Main, and Birch Lane — all of which sell home goods and furnishings. Wayfair's strong digital presence is being driven by overall growth in the online furniture market, despite potential difficulties in delivery logistics for large items.

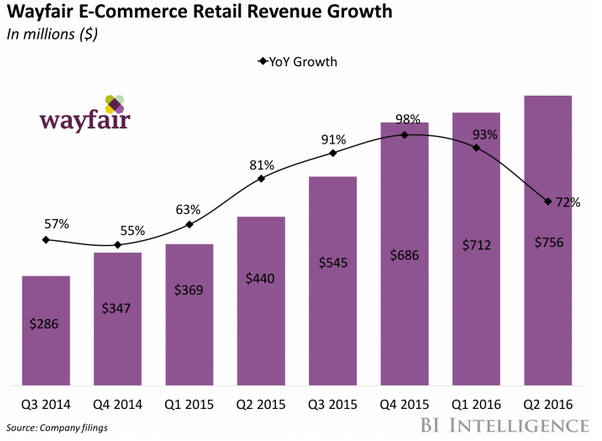

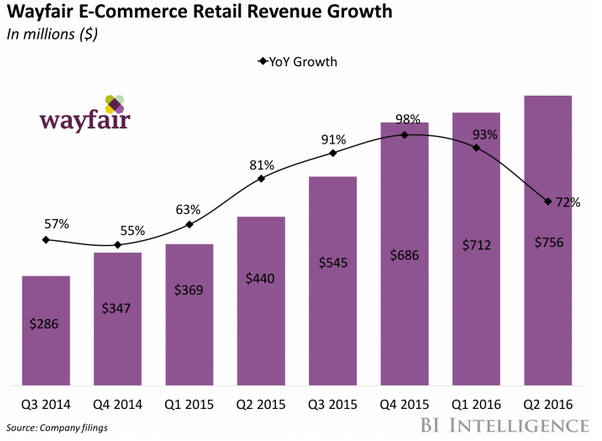

Wayfair's Q2 2016 earnings report demonstrates the opportunity for growth in selling online furniture:

- Total revenue for the company during Q2 2016 totaled nearly $787 million, marking a 60% year-over-year (YoY) increase.

- Direct retail revenue, which consists solely of direct-to-consumer sales generated from Wayfair's e-commerce sites, grew nearly 72% YoY to just over $755 million.

- The number of active customers across Wayfair e-commerce sites reached 6.7 million, a YoY increase of 65%.

- Wayfair delivered nearly 3 million orders during Q2. This is a 50% YoY increase from the same quarter last year.

Another notable point of growth for Wayfair came from its mobile engagement — 38% of all orders placed during Q2 came from a mobile device. This is up from 34% of sales during Q2 2015. Wayfair's strong mobile presence should help boost sales as the company gears up to launch its new augmented reality (AR) app next month. Dubbed WayfairView, the mobile app uses Google's AR technology to let users view furniture for sale on Wayfair as if placed throughout their home.

For example, users can hold a smartphone camera up to their living room, and the phone will show how a couch on Wayfair would look placed there. Considering the size of many furniture items, Wayfair's new app may help build up consumer confidence in such purchases, which means they'll also be less likely to return items. The WayfairView app will grow the company's mobile presence and likely help decrease money lost from returned orders.

Overall, the furniture retail category, which includes home goods, is one of the fastest-growing segments in e-commerce at the moment. Last year, Americans spent roughly $32 billion buying furniture products online, making it the third-largest e-commerce category. The success of sites like Wayfair highlight a growing opportunity for other competitors in the market.

However, this also poses a challenge to delivery logistics companies. Handling oversized packages slows down delivery times and decreases potential volume as they take up more space on a truck. To make up for these deficits, both UPS and FedEx increased the handling fees for large items this past May, reports Logistics Management. As the e-commerce furniture market continues to grow, fulfillment companies will have to figure out new ways to keep revenue growth up, while handling these larger items.

(Source: businessinsider.com)

沪公网安备31010402003309号

沪公网安备31010402003309号